Retirement Savings Contributions Credit (Saver’s Credit)

The Internal Revenue Service offers many tax credits that may be beneficial to you when filing your U.S. income tax return. One of the most beneficial credits available is the Retirement Savings Contributions Credit (or “Saver’s Credit”). The federal government encourages U.S. taxpayers to save for retirement, so much so that they offer a tax credit for doing so. It’s a win-win situation. Saving for retirement is a difficult task for many Americans, but the saver’s credit can help offset some of the costs of saving for retirement.

In order to be eligible for the saver’s credit, the taxpayer must be age 18 or older, they must not be claimed as a dependent on another person’s tax return, and they must not be a student. You are considered a student if during any part of 5 calendar months of the tax year you were a.) enrolled as a full-time student at a school, or b.) if you took a full-time, on-farm training course given by a school or a state, county, or local government agency. A school includes technical, trade, and mechanical schools. It does not include on-the-job training courses, correspondence schools, or schools offering courses only through the Internet.

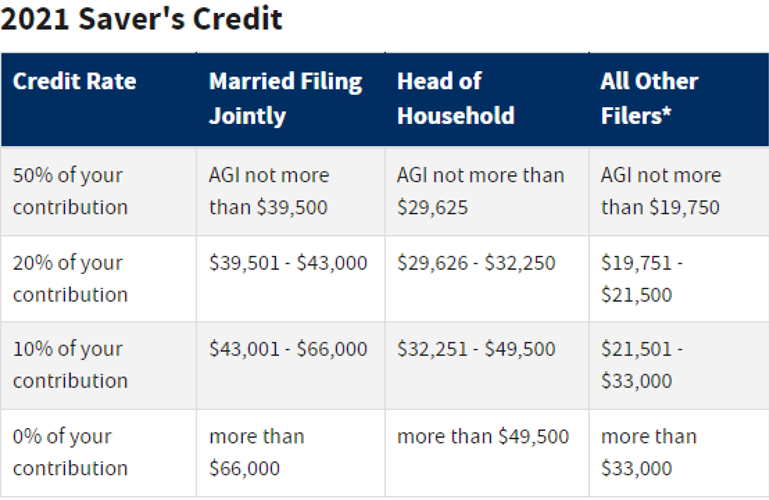

If your adjusted gross income is above any of the following thresholds, you are not eligible for the saver’s credit: $66,000 as a married joint filer in 2021 ($68,000 in 2022); $49,500 as a head of household filer in 2021 ($51,000 in 2022); and $33,000 as any other filing status in 2021 ($34,000 in 2022).

Depending on your adjusted gross income reported on your income tax return, the amount of the saver’s credit is 50%, 20% or 10% of eligible retirement contributions you make, up to a maximum contribution of $2,000 ($4,000 if married filing jointly). Therefore, the maximum credit you can receive is $1,000 ($2,000 if married filing jointly). You may use the chart below to calculate what your saver’s credit would be.

Contributions eligible for the saver’s credit include: contributions you make to a traditional or Roth IRA; elective salary deferral contributions to a 401(k), 403(b), governmental 457(b), SARSEP, or SIMPLE plan; voluntary after-tax employee contributions made to a qualified retirement plan (including the federal Thrift Savings Plan) or 403(b) plan; contributions to a 501(c)(18)(D) plan; or contributions made to an ABLE account for which you are the designated beneficiary.

Rollover contributions do not qualify for the credit. Also, your eligible contributions may be reduced by any recent distributions you received from a retirement plan or IRA, or from an ABLE account. As always, if you have any questions, please contact our firm and we would be glad to assist you.